Why Set Up Family Office In Singapore?

As a growing number of Asian entrepreneurs, tycoons and affluent families prepare to hand over the reins of the business to the next generation, they are turning to family offices to facilitate succession planning and wealth transfer.

Today, a typical family office does more than just manage wealth; it also handles other issues such as tax and legal, succession and philanthropy. Many benefits can be derived from setting up a family office.

One of the most important benefits is that a family office can be highly customised and structured to encompass your vision of the future, investment philosophy, and plan to protect human and intelligence capital. In other words, it is bespoke and personal.

A family office, if structured correctly, can also protect the privacy of family members. A family office allows a family to have all the personal information, such as family compasses, family charters, deeds of donations, shareholder agreements, deeds of incorporations, etc. in one secure place, accessible by only a limited number of people. The family office can therefore serve as the guardian and gatekeeper of the privacy of the family.

Furthermore, wealthy families can take advantage of the family office to ensure the continuity and perpetuity of their wealth. As family wealth is spread over several family members of different generations with different needs, it is crucial to strike a balance between wealth preservation and growth on the one hand and the financial needs of family members on the other hand. One cannot expect the family members individually to keep that balance. Hence, a family office provides a centralised and formalised approach to decision-making.

Finally, a family office is created to establish better governance of family wealth. Family wealth is getting more and more complex, especially in international settings. The family wealth usually grows beyond the ability and capacity of the family to manage it. In most cases, investments became the sole activity and business of the family. As a business on its own, it should be run professionally by a dedicated team of experts.

Setting up a family office can be a complicated process when there are multiple beneficiaries, and the assets are held by different entities and spread across several geographies. Many wealthy families also have members living in different parts of the world, adding to complexities since tax and inheritance laws differ from country to country.

Hence, the ideal country to establish a family office must have established regulatory rules, governing authorities, tax incentives scheme and a stable political environment to preserve a family’s wealth across generations.

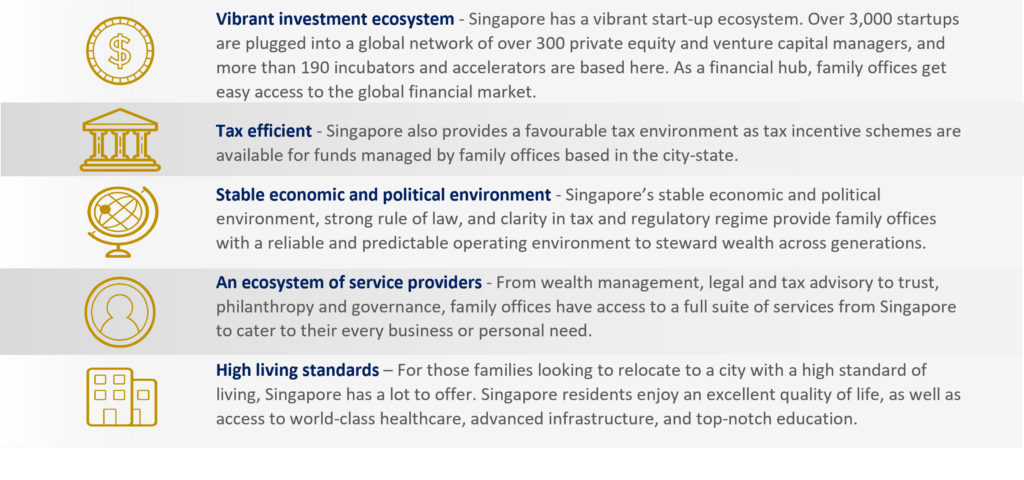

Over the past couple of years, Singapore has gained prominence as the preferred base for family offices. The city-state’s many strengths as a hub for family offices include a stable business and political environment, a strong rule of law, and a deep pool of financial, investment and wealth management talent. Below are some of the common reasons many ultra-wealthy families have chosen Singapore to set up their family offices.

HOW CAN ROCKSTEAD CAPITAL HELP

Our dedicated Rockstead Family Office team, consisting of experienced portfolio managers, analysts, and operational, compliance and legal specialists, has cumulated extensive experiences in helping HNWIs establish family offices utilising the VCC structure.

Rockstead Capital owns a VCC, which allows us to manage the assets and investments of our family office clients through multiple sub-funds. Each family office client simply needs to register a sub-fund under the Rockstead VCC umbrella, which is a straightforward process that will be handled by our experienced onboarding team.

For more information on Rockstead Capital family office services and product offerings, please contact any of our relationship managers or write to Familyoffice@rockstead.com.

Related resources