Fund Management Singapore RS

Fund Offerings & Risk Classification

What is a Fund Management Company?

At Rockstead Capital, the excellence of our in-house funds is a testament to our unwavering commitment to client success. We consistently deliver high risk-adjusted returns that outperform market averages, creating substantial value for our clients. This performance can be attributed to a combination of meticulous research, sophisticated investment strategies, and a strong focus on risk management.

Our funds are designed with stability in mind, providing a safe harbor even amidst market volatility. We achieve this through diversified investment across various asset classes and sectors, alongside advanced risk management techniques. We further differentiate ourselves with a market-neutral approach. By taking long and short positions in different assets within the same market, we mitigate market risk, enabling us to generate profits irrespective of market trends.

Our in-house funds are managed by a team of seasoned professionals, boasting a wealth of industry experience. This expert team brings together a unique blend of financial acumen, foresight, and expertise, facilitating informed investment decisions and consistent returns.

At the heart of our approach is robust risk management. We believe that effective risk management is the cornerstone of successful investment. Our proactive and comprehensive risk management strategies involve continuous monitoring, rigorous stress testing, and adherence to predefined risk limits.

In summary, choosing Rockstead Capital’s in-house funds is not merely an investment decision, but a partnership with a firm dedicated to your financial success and peace of mind. Our commitment to performance excellence, stability, and risk management, combined with our professional fund management and market-neutral approach, makes us the ideal choice for discerning investors.

For more information on Rockstead Capital services and product offerings, please contact any of our relationship managers or write to Enquiries@rockstead.com.

Important Information: The information on this web site should not be considered as an offer, or solicitation, to deal in any funds. The information is provided on a general basis for information purposes only and is not to be relied on as investment, legal, tax, or other advice as it does not take into account the investment objectives, financial situation or particular needs of any specific investor. Any securities mentioned herein are for illustration purposes only. This material shall not be constructed as an offer, recommendation or solicitation to conclude a transaction. Any forward-looking information is subject to inherent uncertainties and qualifications and is based on numerous assumptions. Such forward looking information is provided for illustrative purposes only and is not intended to serve as and must not be relied on by any investors as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability.

Investors should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you. The value of investments and the income from them may go down as well as up and you may not get back the original amount. Past performance is not necessarily indicative of future performance. This document has not been reviewed by the Monetary Authority of Singapore.

Rockstead Private Credit Fund

The objective of the Rockstead Private Credit Fund is to provide attractive monthly income. The fund invests primarily in quality private corporate debt instruments to generate attractive risk-return performance consistent with its income objective.

Fixed Income

The Fund target to disburses a monthly dividend of 0.6%. Investors can anticipate the issuance of dividends on a monthly schedule, typically before the 10th business day of the subsequent month.

Highly Liquid

The Fund does not impose a lock-in period, allowing investors to withdraw without penalty by providing notice before the 15th day of the month.

Systematic Volatility Risk Management

Since its inception, the fund has demonstrated exceptional stability, experiencing no downside volatility or drawdowns. It has consistently achieved profitability in 100% of the reported months.

Rockstead Alpha Fund

Rockstead Alpha Fund is designed for investors looking to outperform the MSCI World Index, predominately focusing on high-quality stocks characterised by their durable competitive advantages or ‘moats’, and overall quality.

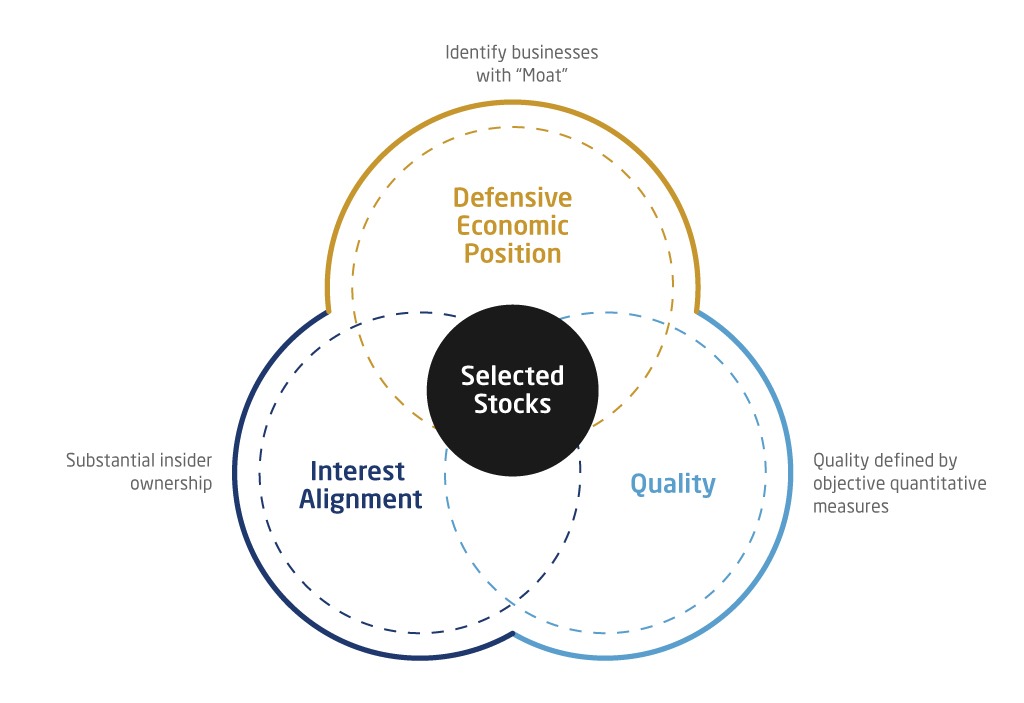

The Fund employs a bottom-up approach to identify optimal investment opportunities, without restriction by sector or geography. It invests in equities that align with the following criteria:

The Fund prioritises companies with a strong and sustainable competitive edge, allowing them to maintain economic profitability over extended periods.

The Fund targets corporations that consistently deliver superior returns on invested capital, demonstrate the capacity to increase free cash flow, exhibit prudent debt management, and show favorable prospects for expansion.

The Fund focuses on companies led by key insiders with significant equity stakes, ensuring that their interests align with the company’s performance and providing diligent oversight.

The Fund may utilize leverage to enhance returns and employ hedging strategies to mitigate tail-end risks during severe economic downturn.

Rockstead Quant Fund

Rockstead Quant Fund (RQF) offers investors access to our non-discretional systematic trading strategy built to outperform the S&P500 index over a market cycle.

The fund is suitable for investors who believe in data driven, or quantitative approach to financial market investing.

Bull Market

Amidst bullish market conditions, our strategy is designed to capture the full spectrum of growth opportunities presented by the US equity market.

Given the robust and historically trend of the US market’s outperformance relative to its global counterparts, our fund is strategically positioned to potentially yield superior returns when compared to other high-risk asset classes.

Bear Market

During bear market conditions, the portfolio expected to lose value, much like any equity funds. However, our strategy will progressively bolster its equity exposure through the use of leveraged ETFs.

This tactic ensures full participation with the market’s recovery and aims to achieve potentially significant gains when the market revisits its previous peak.

Opportunistic

The fund may tactically employ leverage to cushion losses through investment in high quality, interest-bearing private credit instruments.

The fund’s ability to extract yield can potentially help cushion losses during bear market and enhance returns in a good year.