Fund Management Singapore RS

Fund Offerings & Risk Classification

什么是基金管理公司?

在融石资本,我们内部基金的卓越表现证明了我们对客户成功的坚定承诺。我们一贯提供高风险调整后的回报,超过市场平均水平,为我们的客户创造了巨大价值。这种表现可以归功于细致的研究、精细的投资战略和对风险管理的高度关注。

我们在设计基金时的一大考虑为稳定性,即使在市场波动中也能提供一个安全的港湾。我们通过对不同资产类别和行业的多元化投资,以及先进的风险管理技术来实现这一目标。我们以市场中立的方式进一步从市场中脱颖而出。通过在同一市场内对不同资产进行多头和空头头寸,我们可以降低市场风险,使我们能够在不考虑市场趋势的情况下产生利润。

我们的内部基金由经验老到,深具行业知识的专业团队管理。这支专家团队汇集了金融敏锐性、远见和专业知识,确保明智的投资决策和一致的回报。

我们方法的核心是稳健的风险管理。我们相信有效的风险管理是成功投资的基石。我们积极全面的风险管理战略包括持续监控、严格的压力测试和遵守预定义的风险限额。

In summary, choosing Rockstead Capital’s in-house funds is not merely an investment decision, but a partnership with a firm dedicated to your financial success and peace of mind. Our commitment to performance excellence, stability, and risk management, combined with our professional fund management and market-neutral approach, makes us the ideal choice for discerning investors.

欲了解更多有关融石资本的服务和产品信息,请联系我们的关系经理或致函 Enquiries@rockstead.com.

Important Information: The information on this web site should not be considered as an offer, or solicitation, to deal in any funds. The information is provided on a general basis for information purposes only and is not to be relied on as investment, legal, tax, or other advice as it does not take into account the investment objectives, financial situation or particular needs of any specific investor. Any securities mentioned herein are for illustration purposes only. This material shall not be constructed as an offer, recommendation or solicitation to conclude a transaction. Any forward-looking information is subject to inherent uncertainties and qualifications and is based on numerous assumptions. Such forward looking information is provided for illustrative purposes only and is not intended to serve as and must not be relied on by any investors as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability.

投资者在进行任何投资之前,应向财务顾问寻求建议。如果您选择不这样做,应该考虑所选择的投资是否适合您。投资的价值和收入可能会忽低忽高,您可能无法收回原来的金额。过去的表现并不一定预示着未来的表现。本文件未经新加坡金融管理局审查。

Rockstead Private Credit Fund

The objective of the Rockstead Private Credit Fund is to provide attractive monthly income. The fund invests primarily in quality private corporate debt instruments to generate attractive risk-return performance consistent with its income objective.

固定收益

The Fund target to disburses a monthly dividend of 0.6%. Investors can anticipate the issuance of dividends on a monthly schedule, typically before the 10th business day of the subsequent month.

高流动性

The Fund does not impose a lock-in period, allowing investors to withdraw without penalty by providing notice before the 15th day of the month.

系统性波动风险管理

Since its inception, the fund has demonstrated exceptional stability, experiencing no downside volatility or drawdowns. It has consistently achieved profitability in 100% of the reported months.

Rockstead Alpha Fund

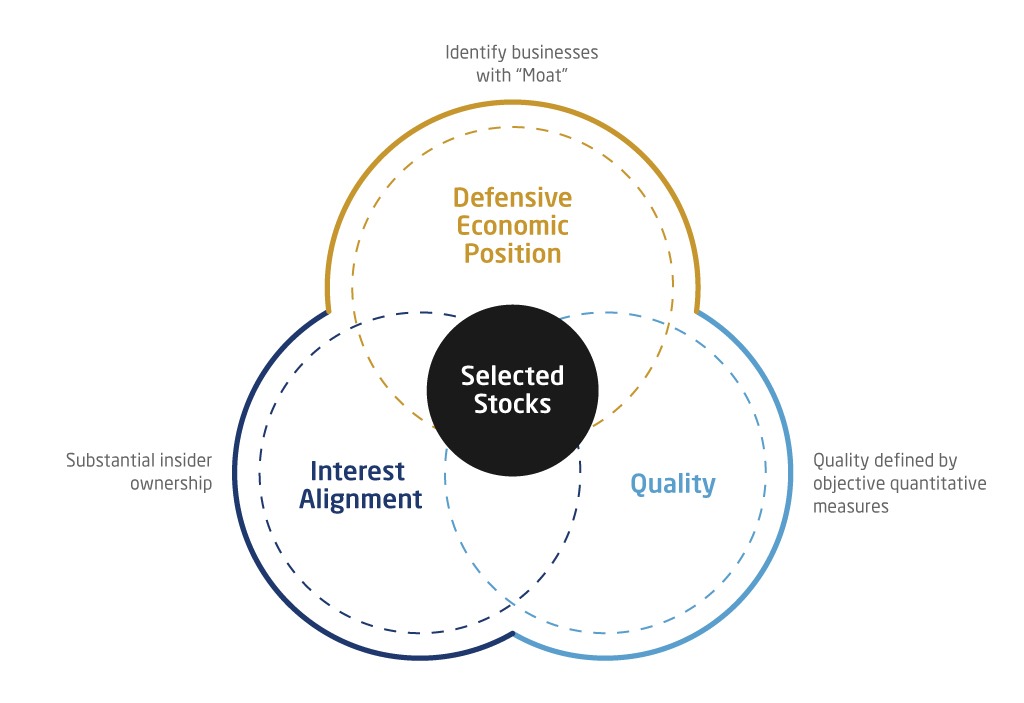

Rockstead Alpha Fund is designed for investors looking to outperform the MSCI World Index, predominately focusing on high-quality stocks characterised by their durable competitive advantages or ‘moats’, and overall quality.

The Fund employs a bottom-up approach to identify optimal investment opportunities, without restriction by sector or geography. It invests in equities that align with the following criteria:

The Fund prioritises companies with a strong and sustainable competitive edge, allowing them to maintain economic profitability over extended periods.

The Fund targets corporations that consistently deliver superior returns on invested capital, demonstrate the capacity to increase free cash flow, exhibit prudent debt management, and show favorable prospects for expansion.

The Fund focuses on companies led by key insiders with significant equity stakes, ensuring that their interests align with the company’s performance and providing diligent oversight.

The Fund may utilize leverage to enhance returns and employ hedging strategies to mitigate tail-end risks during severe economic downturn.

融石定量基金(RQF)

Rockstead Quant Fund (RQF) offers investors access to our non-discretional systematic trading strategy built to outperform the S&P500 index over a market cycle.

The fund is suitable for investors who believe in data driven, or quantitative approach to financial market investing.

Bull Market

Amidst bullish market conditions, our strategy is designed to capture the full spectrum of growth opportunities presented by the US equity market.

Given the robust and historically trend of the US market’s outperformance relative to its global counterparts, our fund is strategically positioned to potentially yield superior returns when compared to other high-risk asset classes.

Bear Market

During bear market conditions, the portfolio expected to lose value, much like any equity funds. However, our strategy will progressively bolster its equity exposure through the use of leveraged ETFs.

This tactic ensures full participation with the market’s recovery and aims to achieve potentially significant gains when the market revisits its previous peak.

Opportunistic

The fund may tactically employ leverage to cushion losses through investment in high quality, interest-bearing private credit instruments.

The fund’s ability to extract yield can potentially help cushion losses during bear market and enhance returns in a good year.